House of brands...or house of cards?

This article was originally published on Brandequity Economictimes

The hyper-accelerated D2C Brands explosion made way for many disruptions, with ‘House of Brands (HOB)’ being the most prominent business model...

The rise of online-first shopping behavior and conscious consumerism fueled the era of direct-to-consumer (D2C) brands. During COVID-19, over 66% of online shoppers purchased directly from D2C brands. Industry projections state this number going up to 80% by 2025.

Expectedly, this significant momentum didn’t go unnoticed by the global investors and was followed by a funding frenzy. In Q1 2021, $1.3 billion of VC funding was raised by D2C brands in the US, with India at $500 million. US witnessed 7 D2C IPOs (Warby Parker, Allbirds, Honest Company, Barkbox, Brilliant Earth, Torrid, FIGS) while India produced D2C unicorns like Licious, MyGlamm, Rebel Foods, and Mamaearth. Fueled by the investor and consumer interest tailwinds, the D2C market is on track to be a $1 trillion global market by 2025, with India’s market size at $100 billion.

The hyper-accelerated D2C Brands explosion made way for many disruptions, with ‘House of Brands (HOB)’ being the most prominent business model. One where the HOB, also referred to as ‘Marketplace based aggregators (MBA)’ acquires several businesses in a certain segment and/or region, leveraging their combined strengths, and scaling them together. This has also been termed as a digital clone of Unilever or P&G. While this concept isn’t new, it found unprecedented interest and quick growth in eCommerce.

The Rise of Thrasio

It all started in 2018 with Thrasio with a team experienced in the growth-hacking of Amazon’s marketplace. Keeping their ties to the ‘Fulfilled by Amazon (FBA)’ ecosystem, they operated on a simple model of acquiring Amazon’s third-party sellers with solid standing across 3 R’s (Reviews, Rating, and Ranking). Thrasio turned profitable in 2019 with 20% margins, entered 2020 at $500 million in revenues with $100 million in profits, and turned unicorn in 2021.

With a valuation reported between $5-10 billion, Thrasio has become a beast with an enormous appetite. Its portfolio of over 200 brands is growing with the acquisition of roughly 1.5 businesses a week. From zero to a billion, Thrasio’s rapid growth is credited to two factors:

1. Fast-paced acquisition process - Thrasio created an acquisition machine to close deals in under 2 months. Thrasio evaluates sellers on trailing twelve months (TTM) earnings and then puts a valuation multiple to the TTM earnings based on a variety of factors like perceived stability of cash flow, competitive positioning (reviews, product rating, SEO ranking), size, margin structure and efficiency of operations.

2. Technology and data-driven systematic approach - Using tools like Keepa, Seller Legend, and PickFu, Thrasio leverages key data insights and actionable hacks to hyper-scale FBA brands.

With such a successful case study in the west, it was inevitable that entrepreneurs around the globe would get inspired to create their own HOB. Several Indian entrepreneurs, especially the digital brand operators launched their own version of HOB, each with a similar proposition on the surface but quite different from the approach and focus perspective.

Given that India has historically been an under-served market from the brands' perspective, this created a golden opportunity for the investors to fuel the HOBs. With an accelerated pace of fund-raise, creating a FOMO amongst investors, the seed rounds went as high as $40+ million. Mensa Brands, founded by ex-Myntra CEO Ananth Narayanan claimed unicorn status within 6 months of launch, the fastest in India and possibly globally.

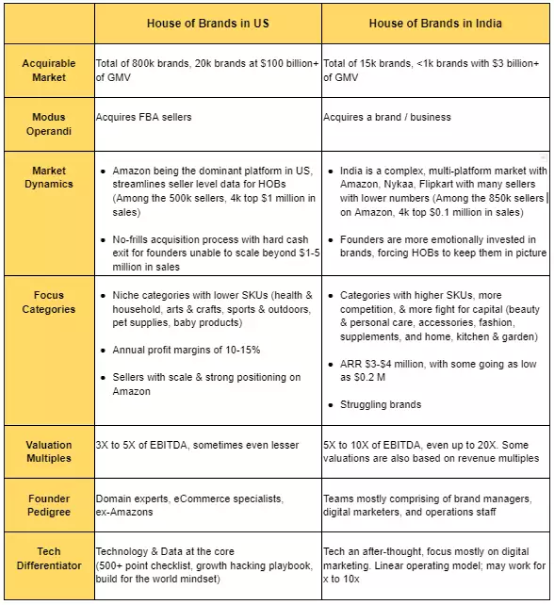

Within a year, nearly $1 billion of VC money was poured into Thrasio clones in India. While there’s a lot of potential in the HOB model, there are several differences between the classic Thrasio model and its clones in India.

The Game of Clones

While every industry evolves with both copycats and challengers, the House of Brands model has unique nuances that must be addressed for long-term viability. The initial euphoria and investments in this space have all been focused on acquiring brands and aggregating revenues faster than the competition. Many founders and investors alike have prioritized brand acquisition at any cost over the operational efficiency and tech differentiation that will separate the winners from losers in this race. Benchmarking the Thrasio model with the existing approach in India throws more light on the same.

Anyone that has built or grown a single brand will tell you how difficult it is to sustainably grow a brand. It is simply unimaginable to grow dozens at the same time without a solid tech differentiator.

It is our firm belief that the Tech differentiator is going to be the fine line between the winners and losers in the HOB space in this digitally native world. Without a differentiated tech, it’s just an aggregation of dozens of brands where each one of them is run independently without many synergies.

Tech is what will prevent a ‘House of Brands’ to become a ‘House of Cards

Tech as the Game Changer

For a House of Brand to give Unilever or P&G a run for their money, they need to solve for sustainable growth both at the unit brand level as well as the efficiency and synergies at the aggregate level. Tech is the only silver bullet.

Tech for unit brand growth

The only easy thing about a D2C brand is launching it. Founders struggle to sustainably scale their business, trying to entice customers who are used to the convenience of marketplaces.

The problem lies in brands still heavily relying on performance marketing to attract their customers to what looks and feels like a typical retailer website. Using legacy eCommerce tech solutions (built for SMBs or retailers), brands continue to chase inorganic growth. With rising Facebook ad prices, worsening ad measurement, Apple’s privacy changes, and oncoming cookie deprecation, this model is set up for failure especially when consumers are constantly desiring a content-rich and community-driven commerce experience.

It is time brands leverage technology and data to build a better D2C flywheel. It is possible with a purpose-built platform that delivers an experiential D2C site, combining the power of great content and engaged communities to deliver sustainable commerce growth.

The Right Way

1. Attract through CONTENT

2. Retain through COMMUNITY

3. Grow through COMMERCE

Tech for aggregate growth

The current HOB model may work for x to 10x growth but will limit the scale within an ingrained ability to leverage data, technology, and operational excellence in this high-stakes game. A relevant approach to redesign the HOB operating model is what we call COSS (Curate, Onboard, Streamline, Scale)

1. CURATE: To efficiently identify the high-potential brands in a limited universe, creating a Brand 360 view for seamless collaboration is a key step. HOBs should build capabilities for business value chain map-based research & analysis, category & segment analysis, competitor benchmarking, and business metrics analysis. Hyper-automating the entire workflow can better the brand watchlists with intuitive recommendations.

2. ONBOARD: Enable rapid & seamless onboarding of brands based on transparent metrics (financial, operational, sales, marketing, distribution). Smarter orchestration of these metrics will enable correct valuation modeling during due diligence, followed by successful closure & handover.

3. STREAMLINE: Once the brand onboards, the next step is to streamline people, processes, and technology. This requires benchmarking and target planning on the basis of sourcing visibility, demand planning, production & distribution systems, and omnichannel order fulfillment capability.

4. SCALE: Hyper-growth of portfolio enabled by a global scaling framework built on consumer feedback, brand vision, omnichannel roadmap, and product expansion strategy. Leveraging a business dashboard to track weekly/monthly/quarterly plans and map with trends will ensure the simultaneous sustainable scale of each portfolio brand.

Avoid Building a House of Cards

While speed is of the essence in the House of Brands model, it's the execution that wins the game. HOBs that are laser-focused on consumers and categories with a non-linear & hyper-automated operations plan will build the future of D2C brands. But if the intent is just to cash in on the buzz, with a focus on quick exits, inorganic growth, inflated numbers, and tech-less foundation, these ventures are doomed to fall like a House of Cards.